montana sports betting tax rate

In Maryland there is a gambling winnings tax rate of 875. 615 South 27th St Suite A.

Legal Us Sports Betting Revenue Handle And State Tax Database

Montana sports betting launched with retail and on-site mobile in early.

. 2022 Montana sports betting. In Tennessee and Wyoming sports betting is only available online Of the states that have not broadly legalized mobile betting three states allow it very narrowly. Montana law specifies that one-third of the VGM tax revenue is distrib- uted to the state general fund and two-thirds to the municipalityor county if the activity occurred outside.

As opposed to taxing a set percentage of revenue the state of Montana keeps all sports betting revenue minus expenses. Unless the context requires otherwise as used in sections 1 through 18 the following definitions apply. This is in line with the national trends where the majority of states have opted for lower rates.

The federal tax on that bet is 025 which results in an effective tax rate of 5 percent of GGR and even more of actual revenue. The state that reported the second-highest hold for the month of October was Montana 129 who has one of the most aggressive sports betting taxation policies in the United States. Wagers can be made through the Montana Lottery app.

- State taxes are currently withheld at a rate of 69 percent. The exceptions to the rule are Delaware New Hampshire and Rhode Island which all have rates around 50 percent and Pennsylvania with a 34 percent rate. Commonly sports betting operators have revenue known as hold of 5 percent of the handle which means that for every 100 you wager the operator takes 5 of which.

General Government Part III Section 9 states All forms of gambling lotteries and gift enterprises are prohibited unless authorized by acts of the legislature or by the people through initiative or referendum. Intralot was awarded the contract without a public bidding process as the Greek company currently is the Montana Lotterys supplier. Run by the Montana Lottery sports betting has been in available since March 2020.

Tax Rates Licensing Fees and Proceed Distribution. If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it. Sports bettors are limited to maximum bets of 250 at a kiosk or 1000 on the website.

Regional sports bettors can also lay some action on popular athletic games using unmanned betting kiosks that are scattered throughout the state. 32 rows How States Tax Sports Betting Winnings. Mississippi Montana and Washington only allow bets from a mobile phone to be placed while on casino premises.

001 Minimum - Maximum depends on the brand. There is a 1000 maximum bet via the app and the minimum age for betting is 18 years old. Handle Revenue Hold Taxes.

12 on gross revenue. The only exception is when children under 18 years are engaging in betting activities conducted by schools churches or other non-profit organizations. Before paying any prize of 600 or greater state law requires the Montana Lottery to check for debts owed to State government.

Information on local and federal gambling laws legal MT sportsbooks sports betting sites and MT mobile betting apps. Even though it was later to the party than the likes of New Jersey and Nevada Montanas entry to the US sports betting sector didnt take long. The only legal option for sports betting in the state is through the lottery and the platform operated by Intralot.

The Video Gambling Machine Tax the major gambling tax in Montana is equal to 15 percent of VGM expendi- tures which are wagers minus payouts. Tax rate on sportsbook operators. Retail sportsbooks in Montana.

Commonly sports betting operators have revenue known as hold of 5 percent of the handle which means that for every 100 you wager the operator takes 5 of which they must pay taxes and expenses. Montana sport betting totals Montana market snapshot. The legal gambling age in Montana is 18 years.

While there are no physical sportsbooks located in any of Montanas larger casinos 180 kiosks or terminals were installed by the Lottery Commission. Sports betting taxes are almost always levied as a percentage of the value of the adjusted. The gambling section of the Constitution Montana Code Annotated 2019 Article III.

What is the tax rate for Montana sports betting. Sections 1 through 18 may be cited as the Montana Sports Betting Act. The tax rate for the HB 725 bill has yet to be confirmed.

However a figure of between 85 and 10 is expected. Montana sports betting bills drafted. The lowest rate is 2 whereas the highest is just under 6 at 575.

1 Adjusted gross sports betting receipts means a sportsbook operators gross sports betting receipts less. Legal sports betting in Montana is now available to residents and visitors through the use of mobile sportsbook apps that can be downloaded to smartphones and tablets. Use this page to report suspicious Gambling Liquor or Tobacco related activities in Montana.

An effective tax rate of 36 and a 10 million licensing fee. - Federal taxes are currently withheld at a rate of 24 percent. Montana Sports Betting Tax Rates Montana has a 69 state tax on gambling winnings.

Gambling Laws Administrative Rules. In the final month of 2018 three draft requests were processed. How did legal sports betting in Montana become a reality.

In-person sportsbooks are not. Sports Wagering Winnings Intercept. 31 rows Since the inception of legal sports betting in 2018 the Garden State has collected 1695.

Montana Gambling Control Division takes gambling crimes very seriously. Since the legal sports betting expansion in 2018 the amount of sports betting revenue has increased dramatically. Call us at 406 896-4300 our physical and mailing address is.

This does not explicitly state sports betting but it. Individual raffle prizes cannot exceed 5000. States have set rules on betting including rules on.

Legal U S Sports Betting Reporting And Information

How To Use Artificial Intelligence To Improve Your Digital Marketing In 2019 Digital Marketing Learn Artificial Intelligence Marketing Campaigns

Legal U S Sports Betting Reporting And Information

Streaming Video Churn Accelerating Deloitte Insights

Streaming Video Churn Accelerating Deloitte Insights

Gambling Winnings Tax How Much You Will Pay For Winning The Turbotax Blog

Gambling Winnings Tax How Much You Will Pay For Winning The Turbotax Blog

2022 Sports Business Awards Best In Sports Media

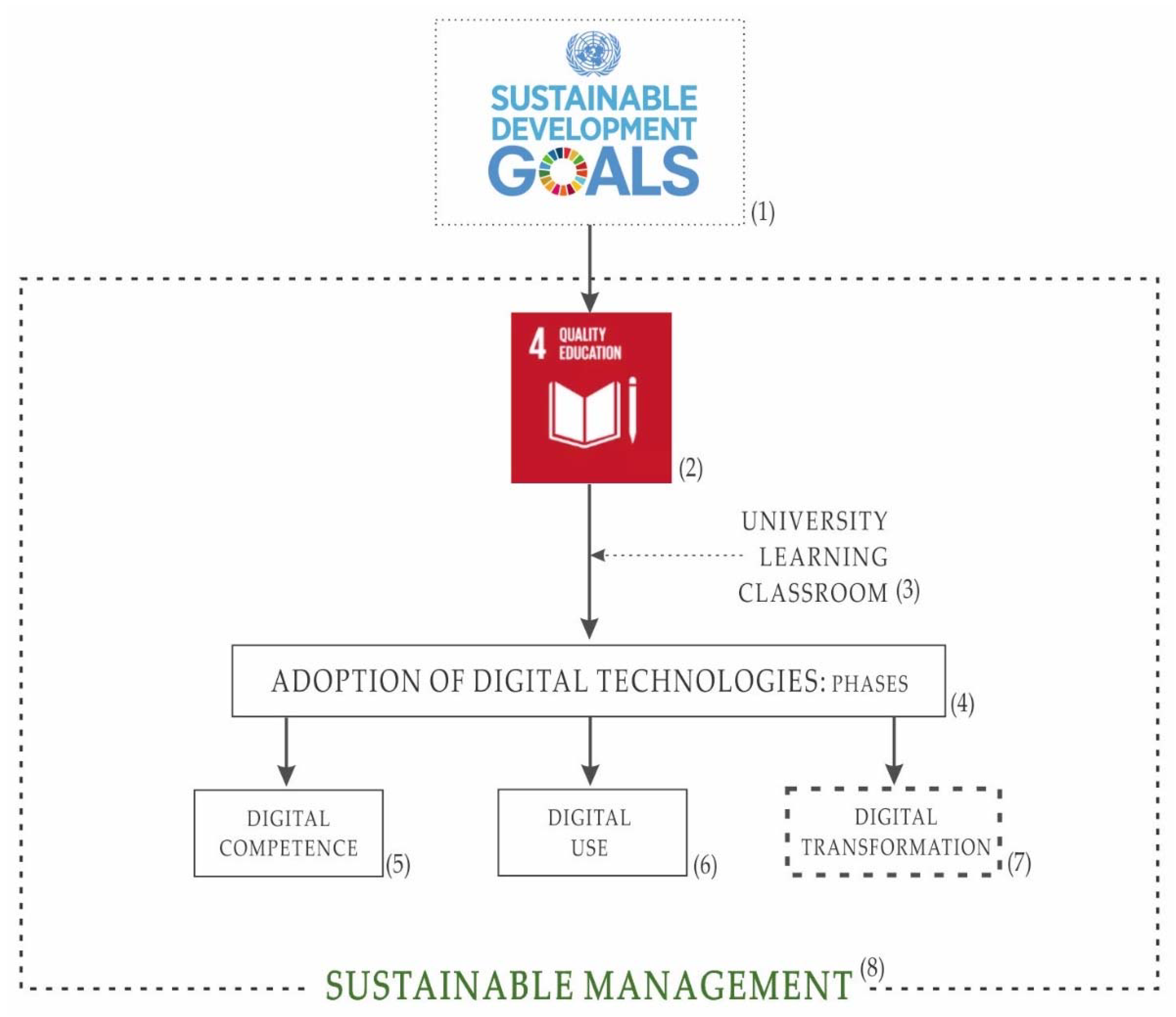

Sustainability Free Full Text Sustainable Management Of Digital Transformation In Higher Education Global Research Trends Html

2022 Sports Business Awards Sports Facility Of The Year

States Where Sports Betting Is Legalized And Possible New Ones In 2022

Mondo As A Tasman Makos 500 Club Member Congratulates Kane Hames David Havili And Liam Squire 3 Mako Men Involved In The Great Test Win Over South Desporto

How To Use Artificial Intelligence To Improve Your Digital Marketing In 2019 Digital Marketing Learn Artificial Intelligence Marketing Campaigns

Loto Romana Notifies Wla And El On Sports Betting Collaboration Lottery Daily